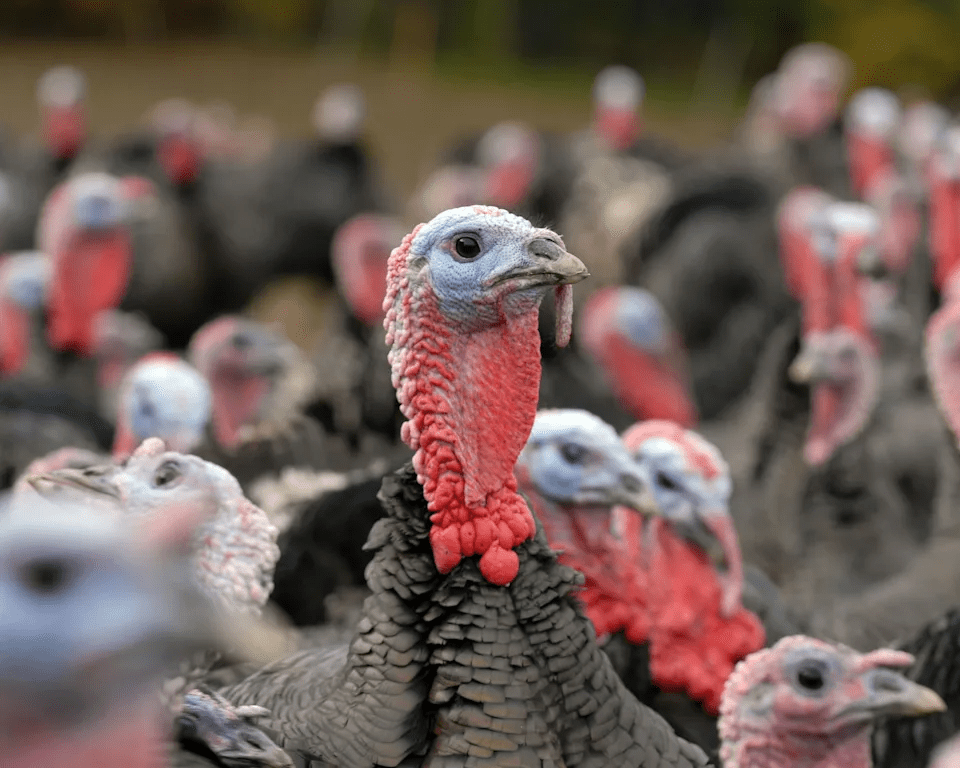

We are seeing a marked surge in the Bird Flu threat across the UK poultry sector, and this increase is creating serious concerns for the Christmas turkey supply. According to industry figures, about 5% of the UK’s seasonal Christmas poultry flock, roughly 300,000 birds, has already been culled due to bird flu outbreaks.

The impact is especially severe among free-range and organic birds, which are more exposed to wild-bird vectors. We examine how this bird flu surge is reshaping the poultry industry, the economics of supply and price, and what it means for retailers and consumers in the UK market this festive season.

Scope of the Bird Flu Surge

Latest Data & Aviation-zone measures

The bird flu season in the UK is proving worse than the same time last year. Officials report around 50 confirmed poultry-farm outbreaks since early October, most in England. By mid-November, industry insiders estimate that about 300,000 birds, roughly 5% of the expected Christmas flock, have already been culled.

The government has responded by enforcing mandatory indoor housing for flocks of over 50 birds from 6 November, extended to Wales on 13 November. These measures aim to reduce infection risk but raise production costs (housing changes, biosecurity).

Impact on Turkeys and the Christmas Supply Chain

Organic & Free-Range Sector Under Pressure

The free-range and organic sub-sector is taking disproportionate damage. For example, one Welsh producer, Capestone Organic Poultry, had to cull 48,000 turkeys after an outbreak.

Because free-range birds are more exposed, they are more vulnerable to the bird flu strain.

Smaller producers may struggle to meet contractual supply volumes. Major retailers, however, appear confident of meeting overall demand thanks to strong supplier agreements.

Economic Consequences: Price and Availability

Retail Pricing and Consumer Impact

The bird flu outbreak is already feeding through to potential pricing effects. Some analysts suggest smaller Christmas birds and limited premium free-range turkeys will put upward pressure on prices.

In the US, for comparison, wholesale turkey prices are up ~40 % year-on-year due to a shrinking flock and bird flu. While UK data is more limited, market watchers expect retail cost increases.

Points to note:

- Supply of heavier birds may shrink as farmers process early to avoid flu risk.

- Smaller retailers may face more acute supply gaps or higher cost burdens.

- Larger retailers are likely able to absorb or allocate resources differently due to scale.

The key takeaway: bird flu is not just a health issue; it is a cost-and-supply issue with clear downstream consumer impacts.

Industry Response and Risk Management

Producer and Retail Mitigation Strategies

Producers are accelerating slaughter schedules and enhancing biosecurity to limit losses from bird flu. The government’s establishment of a national Avian Influenza Prevention Zone imposes stricter hygiene and movement controls.

Retailers, particularly larger chains, are leaning on strong supply contracts and may shift more to indoor-reared birds to mitigate free-range flu risks. Smaller suppliers and independent butchers may find it harder to compete on cost or availability. Don’t miss our recent post about McDonald’s Launches New Grinch Happy Meal With Festive Menu Items.

Broader Implications for the UK Poultry Sector

Trend Analysis & Strategic Takeaways

The bird flu season of 2025 may serve as a turning point for the UK poultry sector. Previous severe outbreaks (e.g., 2022/23) have already stressed the system; this year’s wave compounds those pressures.

The trend suggests rising costs of production (housing orders, bio-security) and potential premiumization of “bird flu-safe” poultry (indoor-reared or heavily bio-secured free-range). Retailers may shift allocation to larger suppliers capable of scale.

In practical terms:

| Factor | Large retailers gain an advantage |

|---|---|

| Housing & bio-security | Higher per-bird cost for producers |

| Free-range vulnerability | Larger cull risk, fewer birds available |

| Scale of retail supply | Large retailers gain advantage |

| Price to consumer | Likely upward pressure this festive season |

Bottom Line

We conclude that the bird flu outbreak in the UK is generating a clear and measurable disturbance in the poultry industry: around 5% of the Christmas bird flock has already been culled, free-range producers face acute risk, and price pressures are increasing. Major retailers are likely to maintain supply, but smaller operators and premium free-range segments face stress. For the sector going forward, stronger risk management, re-thinking of free-range exposure, and cost-pass-through mechanisms will become more important.