- Why Licenses Exist

- Who Counts as a Business

- What the License Means

- Who Does Not Need a License

- What It Costs

- How Long It Takes

- What Happens If Things Go Wrong

- Different Kinds of Activities

- How Oregon Differs from Other States

- Steps to Get Licensed

- Risks of Skipping It

- Final Thoughts

- FAQs

- References

- About the Author

I know how confusing it feels when you’re ready to start a business, but all the rules and permits seem overwhelming. Many people ask, “do i need a business license in stanfield oregon?” The short answer is yes most businesses in Stanfield require one. But the details matter, and that’s what we’ll walk through together.

Why Licenses Exist

We sometimes think a license is just another piece of paper, but in Stanfield, it serves an important role. The city requires licenses to protect public health, safety, and welfare. Getting approval doesn’t mean you can break other laws or skip state rules, but it ensures your business is legally recognized in the city.

Who Counts as a Business

They make it clear that a business isn’t just a big shop downtown. The city defines it broadly:

- Any profession, trade, or occupation where money changes hands.

- Shops selling goods or materials.

- Service providers, from hair stylists to consultants.

- Home-based businesses, if customers or income are involved.

Renting out a single home doesn’t count, but if you own apartments, motels, RV parks, or more than three rentals, that is a business.

What the License Means

We should think of a license as permission. It allows us to legally operate within Stanfield’s city limits. Without it, you could face suspension, revocation, or even fines. Each day you operate without a license could be a separate offense, costing up to $250 per violation.

Who Does Not Need a License

Not every person has to apply. Stanfield lists clear exemptions:

- People working for wages or salaries (your employer handles compliance).

- Businesses already paying a franchise fee to the city.

- Wholesalers delivering to local retailers.

- Minors under 16 earning less than $1,500 yearly.

- Babysitters.

- Nonprofits with approved tax-exempt status (the city council may waive their fees).

These exceptions matter because they save small or casual earners from unnecessary paperwork.

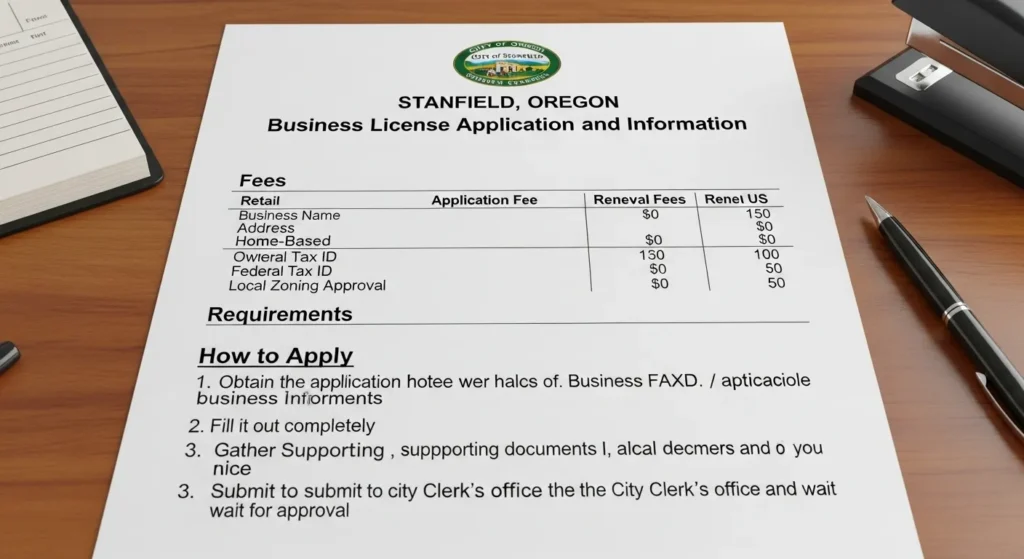

What It Costs

We all want to know the price upfront. In Stanfield, most small businesses pay between $25 and $100 annually. Across Oregon, fees vary and can run higher depending on your type of business, but Stanfield keeps costs reasonable.

- Annual fees are due on July 1 and cover you until June 30.

- If you apply after June 30, you pay half the fee.

- Licenses expire December 31, so renewal is part of the yearly cycle.

How Long It Takes

They don’t make you wait forever. Once you submit your complete application and fee:

- Most approvals happen within one or two business days.

- If zoning or other checks are needed, it could take up to 30 days.

That means if you plan ahead, you won’t face major delays before opening.

What Happens If Things Go Wrong

Sometimes businesses run into trouble. The city can deny, suspend, or revoke a license.

- Suspension means you pause operations until a problem is fixed.

- Revocation means you lose permission to operate.

- Denial can happen if requirements aren’t met.

You can appeal within 15 days to the city council, or 10 days if it’s a summary suspension for immediate danger. If your license is revoked twice in a year, you must wait two years before applying again. That’s serious, so staying compliant is key.

Different Kinds of Activities

We may think all businesses are treated the same, but Stanfield has special chapters for different operations. Let’s look at them one by one.

Mobile Food Vendors

If you run a food truck or trailer, rules apply:

- Units must be self-contained (no tanks or water on the ground).

- Operating areas must be paved, graveled, or landscaped.

- You can only operate in commercial or industrial zones.

- Stay 200 feet away from restaurants unless they give written consent.

- Provide at least one 35-gallon trash can.

- Move your unit at least 400 feet once a week.

- No business between 9 p.m. and 6 a.m.

Violations are a Class B offense, and penalties can add up quickly.

Garage Sales

Even casual sellers face rules:

- You need a $4 permit, good for three days.

- Only two sales per year are allowed per person or property.

- Signs are limited to two on the premises.

- Sales must be between 9 a.m. and 9 p.m.

- Violations cost $10 to $100 per offense.

It may feel small, but Stanfield regulates garage sales like any other public business activity.

Merchant Police

If you run a private security service:

- You must get a license from the chief of police.

- Each person must pass a background check.

- A $100,000 surety bond is required.

- Fees: $10 per year for an individual guard, $25 for a business.

- Violations could bring $200 fines or 60 days in jail.

This ensures that those protecting property meet high standards.

Transient Room Tax

Operators of hotels, motels, RV parks, or short-term rentals must collect a 3% lodging tax.

- It applies to stays of 30 days or less.

- Taxes are due quarterly.

- Penalties for nonpayment include fines of 10–25%, plus 1.5% monthly interest.

- Records must be kept for 3 years, 6 months.

This is separate from your business license, but both apply if you host paying guests.

Fuel Tax Fund

The city also manages a Fuel Tax Fund. While not a license itself, fuel-related businesses must ensure tax compliance under a fund established in 2002.

How Oregon Differs from Other States

We should also look at how Oregon works compared to other places.

- Oregon: No statewide general license. Instead, register your business with the Secretary of State and secure local licenses like in Stanfield. Industry-specific licenses may also apply.

- Florida: Requires a local business tax receipt in most counties and cities, plus state-level permits for certain industries.

- Federal level: No general license, but some industries (aviation, firearms, broadcasting) require federal approval.

This comparison shows how much local rules matter. In Stanfield, your city license is as important as your state registration.

Steps to Get Licensed

We can break it down simply:

- Register your business with the Oregon Secretary of State (unless you’re exempt).

- Complete the Stanfield business license application.

- Pay the fee ($25–$100).

- Wait for approval (1–30 days).

- Renew yearly before December 31.

If your business changes (address, ownership, etc.), you must notify the city within 10 days.

Risks of Skipping It

These are the real consequences if you skip the license:

- Daily fines of up to $250.

- Forced business closure.

- Denial of future applications.

- Loss of trust with customers.

Compliance is far cheaper and less stressful than paying penalties.

Final Thoughts

I’ve walked you through the essentials of business licensing in Stanfield, Oregon. We saw how licenses protect the public, how fees and renewals work, what exemptions apply, and how specific activities like food trucks, garage sales, and rentals face extra rules. Do i need a business license in stanfield oregon?

If you plan to start a business here, take the time to apply. It’s affordable, quick to process, and saves you from costly fines. My advice: don’t see a business license as a burden—see it as your official green light to move forward with confidence.

FAQs

Do I need a business license to operate in Stanfield?

Yes. Most businesses, including home-based ones, must have a city license to operate legally in Stanfield.

How much does a Stanfield business license cost?

Annual fees usually range from $25 to $100, depending on the business type.

Are there exemptions to getting a license?

Yes. Minors under 16 earning under $1,500, babysitters, nonprofits, wage earners, and certain wholesalers may be exempt.

How long does approval take?

Most licenses are approved in 1–2 business days if complete, but may take up to 30 days if zoning issues arise.

When do business licenses expire in Stanfield?

Licenses expire December 31 each year, with renewal fees due by July 1 for the following cycle.

References

- City of Stanfield, Oregon. Business Licenses – Chapter 5.04. Ordinance No. 378-2006 (May 2, 2006); amended by Ordinance No. 455-2023 (July 18, 2023, effective September 1, 2023).

- City of Stanfield, Oregon. Mobile Food Vendors – Chapter 5.06. Ordinance No. 422-2017 (October 3, 2017); amended by Ordinance No. 440-2020 (February 4, 2020).

- City of Stanfield, Oregon. Garage Sales – Chapter 5.12. Ordinance No. 124-77 (1977); amended by Ordinance No. 207-82 (1982) and Ordinance No. 282 (1994).

- City of Stanfield, Oregon. Merchant Police – Chapter 5.16. Ordinance No. 194-81 (1981).

- City of Stanfield, Oregon. Transient Room Tax – Chapter 5.60. Ordinance No. 392-2010 (November 2, 2010).

- City of Stanfield, Oregon. Fuel Tax Fund. Ordinance No. 355-2002 (June 4, 2002).

- Oregon Secretary of State. Business Registry Information. Salem, OR.

- Oregon Business Xpress. License Directory and Permits Guide. Updated May 20, 2025.

- U.S. Small Business Administration (SBA). Federal Licenses and Permits Overview.

- Florida Department of Business & Professional Regulation. DBPR Online Services. Updated September 16, 2025.

Disclaimer: This article is for general informational purposes only and does not replace legal or professional advice. Always check with the City of Stanfield or state agencies for current licensing requirements.

About the Author

Chang Russell is an expert in small business law and local licensing regulations. With extensive experience in Oregon compliance, he helps entrepreneurs navigate permits and legal steps. His mission is to simplify rules so business owners can focus on growth.